Rooted in stability and strength. growing with a vision for the future.

2022 Annual Report

Annual Meeting

Monday, June 5, 2023 | 5 pm

Oconee State Bank

Corporate Headquarters

41 N. Main Street

Watkinsville, Georgia 30677

Investor Relations

James R. McLemore

Executive Vice President &

Chief Financial Officer

Oconee Financial Corporation

Post Office Box 205

Watkinsville, Georgia 30677

Transfer Agent

Broadridge Corporate Issuer Solutions

PO Box 1342

Brentwood, NY 11717

1-877-830-4936

Oconee Financial Corporation

41 N. Main Street

Post Office Box 205

Watkinsville, Georgia 30677

Telephone: (706) 769-6611

Facsimile: (706) 583-3878

www.oconeestatebank.com

Independent Registered Public Accounting Firm

Mauldin & Jenkins, LLC, Certified Public Accountants

200 Galleria Parkway

Suite 1700

Atlanta, Georgia 30339

President’s Letter

In 2022, we continued to display exceptional strength, which stems from the unwavering commitment of our shareholders, employees, communities, and all stakeholders. Strength becomes increasingly evident when obstacles are present. As you will see throughout this annual report, the bank performed exceptionally well, even in the midst of unstable economic conditions.

In regard to our financial performance, we exceeded our budgeted net income, which has resulted in a significant increase in dividends to be paid to our shareholders this year. We are thankful for our talented team, strategic execution, and sound operations. This has boosted our financial performance and enhanced our ability to carry out our vision to be essential to the lives, businesses, and communities we serve.

We continue to develop bold strategies that will drive the Bank forward and allow us to grow in size and profitability. In 2023, we are committed to further developing our leaders through tailored programs that emphasize our mission, vision, and values. The Bank will continue to leverage market expansions and enhancements to Small Business Administration Lending (SBA) and Remarkable Mortgage. These initiatives will enhance the quality of service and solutions we strive to bring to those we serve.

In recent months, we have added both Selena Ruth and John Davis to our Executive Leadership Team. Selena now serves as Chief Human Resources Officer and John has assumed the position of Chief Innovation and Technology Officer. Both Selena and John join the team with a wealth of knowledge and experience in their respective areas. These hires illustrate our commitment to recruiting top talent and equipping our team with the resources needed to foster our continued growth and success.

In closing, and on behalf of our team, we want to thank you for your investment in Oconee State Bank and for your continued support. Each day, we work diligently to increase your shareholder value, while continuing to become Georgia’s most remarkable community bank.

Neil Stevens

President and CEO

Financials

”Oconee State Bank and Oconee Financial Corporation's financial results for 2022 reflect a significant improvement over 2021.

Jim McLemoreChief Financial Officer

2022 Results: Earnings, Dividends, Book Value, and Stock Value

Oconee State Bank and Oconee Financial Corporation’s financial results for 2022 reflect a significant improvement over 2021. Despite reductions in 2022 for PPP income of $2.1 million and mortgage income of $1.1 million, we are pleased to report 2022 net income of $4.1 million versus $3.0 million in 2021. This represents an increase of 37%. The increase in net income was driven by higher net interest income (excluding the reduction in PPP fees) of $2.9 million resulting from higher interest rates and an increase in SBA income of $896,000 due to the ramp up of our SBA lending program in late 2021. Oconee Financial Corporation paid a dividend of $0.70 per share in April 2022, an increase of 8 percent over the prior year dividend of $0.65 per share. Our book value per share decreased from $43.88 to $32.43, a decrease of 26 percent. This is primarily due to the recording of unrealized losses on our bond portfolio in 2022 of $13.8 million. Although rising interest rates substantially improved our net interest income, they also negatively impacted the value of our bond portfolio. This is an industry wide issue and not unique to our bank. The Board of Directors voted to increase the 2023 annual dividend to $0.85 per share, an increase of 21 percent. Oconee Financial Corporation’s stock, which trades on the OTCQX exchange under the ticker symbol “OSBK,” decreased from $44.00 per share at year-end 2021 to $37.11 per share at year-end 2022. Overall, bank stocks declined in 2022 and our stock price reflects this general decline.

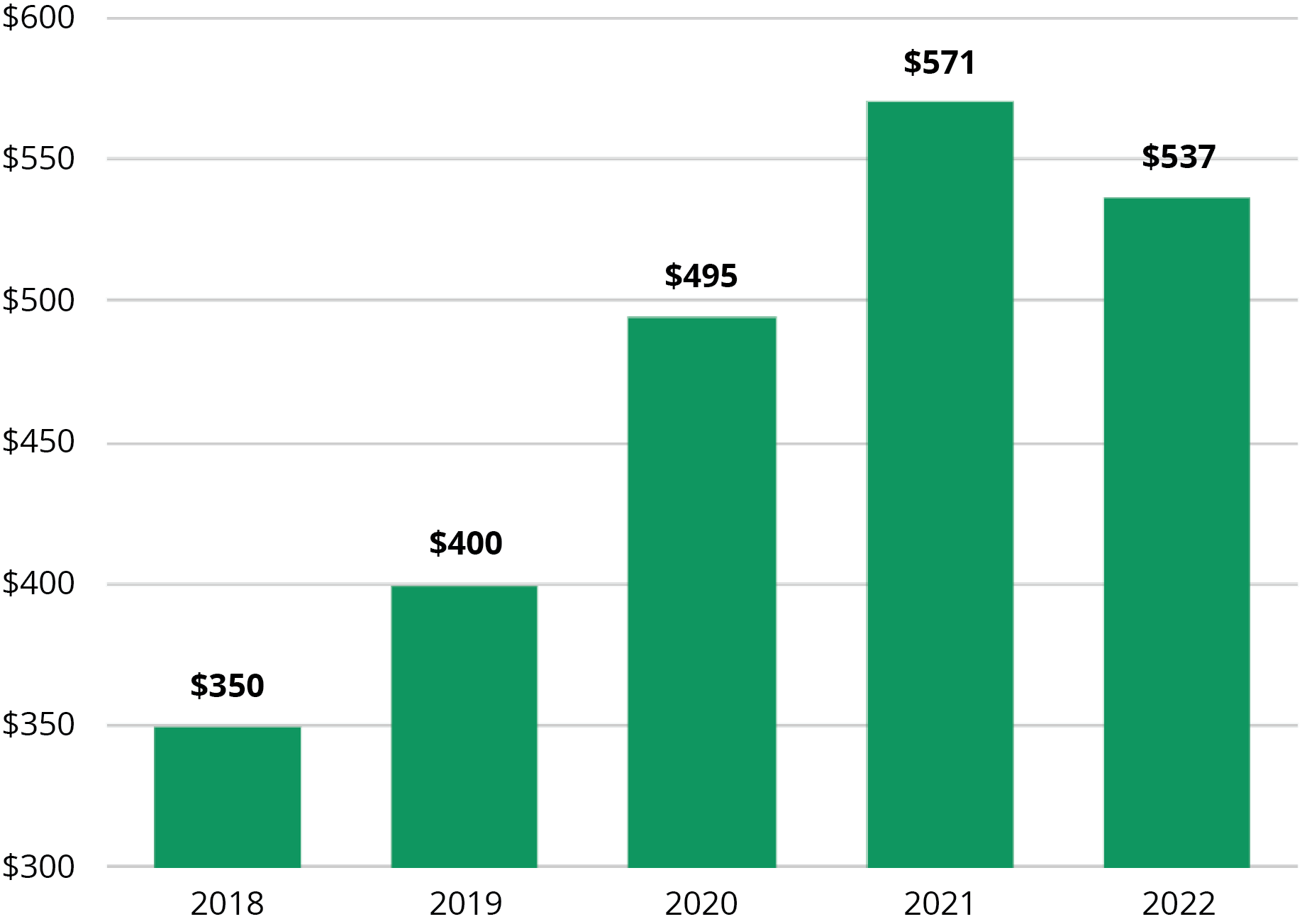

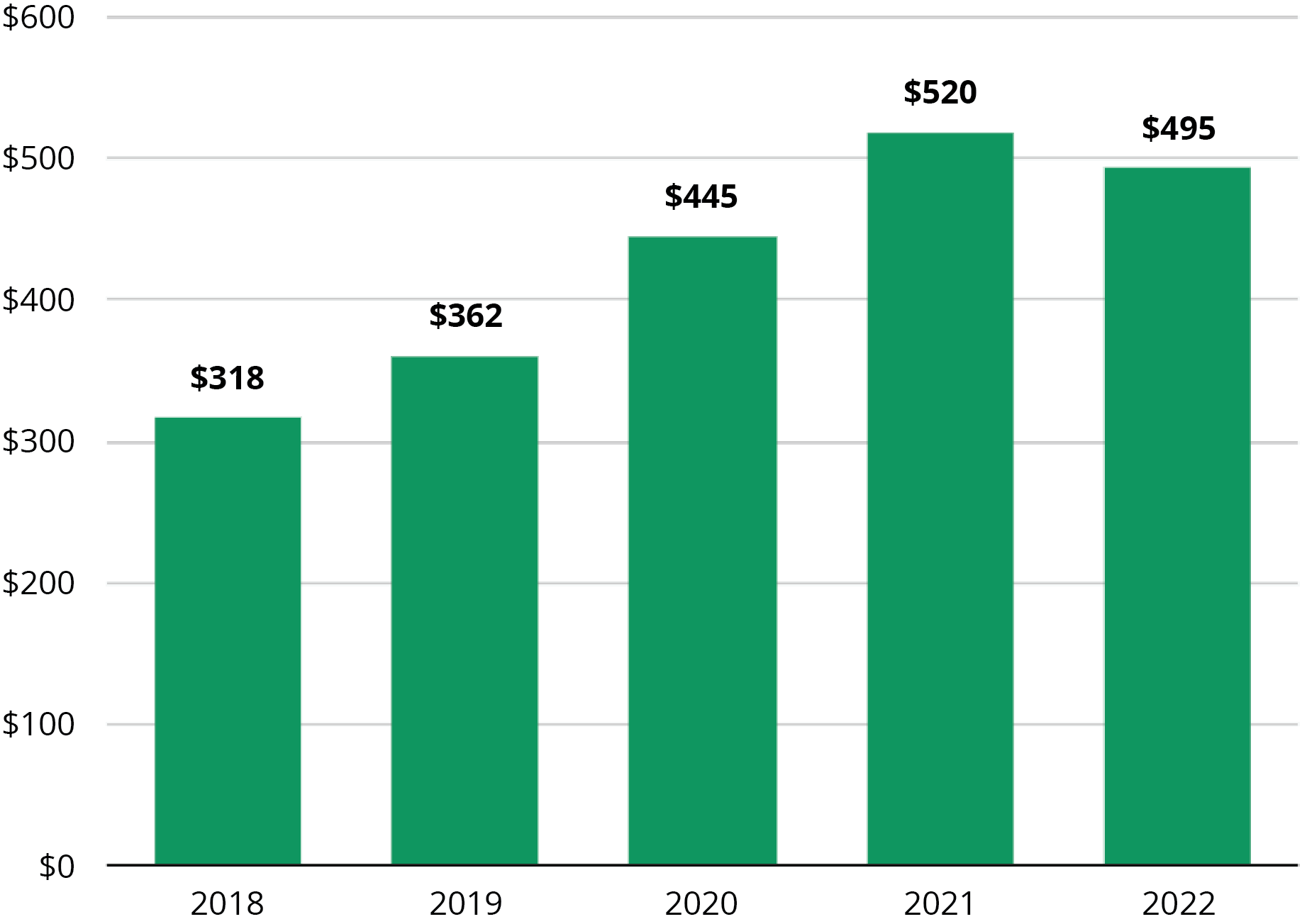

Balance Sheet

The Bank ended the year at $536.8 million in assets. This represented a decline of $34.4 million, or 6.0% versus year end 2021. This is largely due to a net decline in deposits of $24.8 million, or 4.8%. We experienced 44% cumulative growth in deposits between year-end 2019 and year-end 2021, due to the strong inflow of funds from government stimulus money as well as higher savings rates of consumers and businesses. In 2022 government stimulus money was curtailed and consumer and business savings rates declined, resulting in a net outflow of deposits in 2022. The vast majority of our deposit outflow in the last quarter of the year was attributable to asset purchases such as real estate and equipment as opposed to deposits moving to other banks and brokerage firms. We continued to focus heavily on expanding the deposit relationship of our existing and prospective customers to ensure that Oconee State Bank is their primary financial institution.

Lending and Credit Quality

Total loans decreased $3.5 million or 1.1%. PPP loans declined by $3.7 million. The Bank saw a record level of loan production in 2022 but also experienced a sharp increase in loan prepayments as compared to prior years. Past dues remained extremely low and were only 0.08% of loan balances at 12/31/22. For 2022, we had loan recoveries of $11,000 and charge offs of $4,000 which resulted in a net recovery of $7,000.

Financial Highlights

(Dollars in thousands, except per share data)

2022

2021

Financial Condition at December 31,

Total assets

$ 536,748

$ 571,142

Investment securities

159,640

162,165

Loans (net of unearned income)

300,130

302,523

Allowance for loan losses

(4,549)

(4,542)

Total deposits

494,870

519,694

Subordinated notes

9,818

9,794

Shareholders’ equity

29,083

39,333

Results of Operations for the Year Ended December 31,

Interest income

$ 17,852

$ 17,272

Interest expense

1,443

1,646

Net interest income

16,409

15,626

Provision for loan losses

0

456

Net interest income after provision for loan losses

16,409

15,170

Noninterest income

4,850

4,381

Noninterest expenses

15,930

15,819

Income before income taxes

5,329

3,732

Income tax expense

1,205

732

Net income

$ 4,124

$ 3,000

Per Share Data

Earnings per share

4.60

3.35

Cash dividends paid

0.70

0.65

Book value per common share

32.43

43.88

Weighted average shares outstanding

896,991

896,260

Performance Ratios

Return on average assets

0.75%

0.56%

Return on average equity

13.29%

7.73%

Net interest margin

3.20%

3.05%

Efficiency ratio

75.54%

80.02%

Net Income ($Millions)

Total Loans ($Millions)

Book Value Per Share

Total Assets ($Millions)

Total Deposits ($Millions)

Asset Quality Highlights

The Bank continues to place its highest emphasis on growing the Owner-Occupied Commercial Real Estate portion of our loan portfolio, which is demonstrated by it being the largest segment of the loan portfolio at 34%. This strategy is based upon these loans representing (1) a significant influence on garnering the entire banking relationship of the business and business owners and (2) one of the safest categories of loans in the marketplace. Additionally, the Bank continues to maintain a well-balanced loan portfolio mix with 31% of the portfolio in a diversified mix of Non-Owner Occupied Commercial Real Estate, and 17% of the portfolio in various types of 1 to 4 Family Housing loans.

12/31/2022 Loan Portfolio Composition

Historical Charts

In 2022 the Bank reflected very modest loan portfolio growth of $1.3 Million (.43%), excluding SBA PPP loans. This was predominantly a result of loan payoffs being 38% higher than the average of the two prior years. These payoffs were not the result of losing loans or relationships to other financial institutions, but a function of numerous borrowers electing to accept very attractive offers to sell either their business or their real estate due to the robust economic conditions.

During 2022 the Bank also produced the greatest volume of new loan closings in the last six years. Much of this volume involves new construction of commercial real estate projects, which has resulted in the unfunded portion of this category of loans being over $20 Million higher than the prior year. We anticipate these loans fully funding over time, which should translate into greater growth than shown in 2022.

Over the last five years the Bank has grown the loan portfolio by 78% or a Compound Annual Growth Rate of 12.2%. Additionally, during these five years the Bank’s focus on growing small business relationships by targeting Owner-Occupied Commercial Real Estate loans has resulted in that portion of the loan portfolio accounting for 35% of the growth, growing by 90% or a Compound Annual Growth Rate of 13.7%. Similarly, Non-Owner Occupied Commercial Real Estate has accounted for 39% of the growth, and 1 to 4 Family Housing loans have accounted for 11% of the growth.

Over the last five years the Bank has grown the loan portfolio by 78% or a Compound Annual Growth Rate of 12.2%. Additionally, during these five years the Bank’s focus on growing small business relationships by targeting Owner-Occupied Commercial Real Estate loans has resulted in that portion of the loan portfolio accounting for 35% of the growth, growing by 90% or a Compound Annual Growth Rate of 13.7%. Similarly, Non-Owner Occupied Commercial Real Estate has accounted for 39% of the growth, and 1 to 4 Family Housing loans have accounted for 11% of the growth.

5 Year Loan Growth Portfolio

Percentage of total Growth by Segment

2017 – 2022

Historical Loan Portfolio Totals and Composition (000's)

(2020 & 2021 excluding SBA PPP outstandings of $55,237 and $3,736, respectively)

Digital Highlights

Business Services

226,881,127

145,830

100,080

147,924,518

48,669

161,719

eBanking Services

20,145,033

23,758

14,729

34,753,758

53,595

Get to know our Remarkable Digital Services Team!

Mid-year, we introduced our newly formed Digital Solutions Center (DSC). The DSC is a one-stop shop for all digital banking services, providing remote support through incoming calls and emails, as well as outbound service initiatives. This team has been integral in our efforts to enhance e-banking adoption and grow and retain core deposits, while contributing to strategic goals in the digital banking space. We look forward to the future of the DSC as we implement innovative technology and enhanced products, with the same exceptional service offered since 1960.

Casey Bradshaw

Digital Solutions Center Manager

Linda Vaughn

Digital Solutions Specialist

Digital Services

-

Online Banking

-

Mobile Banking

-

Telephone Banking

-

Mobile Deposit

-

Bill Pay

-

E-Statements

-

Digital Wallets

-

Commercial Cash Management

-

Remote Deposit

-

Positive Pay

-

Remote Deposit Capture

Cyber Security & IT Highlights

Our Information Technology Division plays a lead role in maintaining our network systems. As cyber threats continue to evolve, this team is instrumental in ensuring formidable barriers to protect our customers from cyber-attacks, data breaches, and other threats that may put personal and financial data at risk. A key component of mitigating cyber risk is awareness and education of those we serve. The following information illustrates how all stakeholders can be aware, join forces with their financial institutions, to further strengthen our stance against cybercrime.

Andy Hancock

Technology Specialist

Christian Watkins

Technology Specialist

Jamie McFalls

VP, Information Technology

John Davis

EVP, Chief Innovation and Technology Officer

We are thankful for our talented Information Technology Team, not only for their work in the cyber space, but also for all they do to ensure our team has the technology, at their fingertips, to serve our customers with excellence.

Retail

We are excited to share the installation of a new ATM in the Classic City! Available, 24/7, the ATM is positioned in front of our Athens Financial Center at One Press Place in beautiful downtown Athens. We look forward to serving the banking needs of the community through this delivery channel in the heart of Dawg country!

We are expanding into the Macon/Central Georgia area! Led by SVP/Community President, Robby Redmond, we are excited to bring our vision, mission, and values to Central Georgia! We have identified space at the corner of Third and Mulberry Streets to be the home of our Macon Financial Center and are undergoing renovations. We look forward to becoming Remarkable on Mulberry in 2023!

Work began in 2022 for the installation of a new ATM in Gwinnett County at the Gwinnett Financial Center at 2055 Sugarloaf Parkway, Duluth. With the ability to make deposits or withdrawals, this 24/7 ATM will be a great addition to the Gwinnett market in 2023!

Market Teams

Oconee

“The Oconee Market team experienced continued success in 2022. Yearly loan production increased 13% to thirty-six million, all while maintaining a healthy loan portfolio in tough lending environment. Our Retail Team continued growth by increasing deposits, while exceeding budget and providing first class service to customers. I am excited about out team, the ways we continue to engage within our local community, and how we are poised for future success.”

Hal Jackson

SVP, Community President/Oconee

Athens

“Strong loan growth of over forty-five million marked another fantastic year for the Athens Market Team. Our team continues to impress us in their efforts to deepen banking relationships, elevate the Oconee State Bank presence in the Classic City, and pursue new opportunities at every turn. We are excited about 2023 and the momentum we have moving into the new year.”

Chad Thomason and Phillip Edwards

SVP, Community Presidents/Athens

Gwinnett

“2022 was a good year for the Gwinnett Market Team. As a whole, we did a great job retaining existing customers. Loan production increased, new customer relationships were created and the Oconee State Bank brand continued to shine and gain recognition within the local community. We appreciate the support of our team as we strive to become Gwinnett’s most REMARKABLE bank.”

Joe Godfrey

SVP, Community President/Gwinnett

Macon

“The Macon team had a strong and productive year in 2022. New loan and deposit relationships were established, a new location was selected in the heart of downtown Macon, and a team seasoned bankers were hired. We are excited to see expansion of the remarkable OSB brand into the Macon market and we look forward to growing valued relationships within the local community.”

Robby Redmond

SVP, Community President/Macon

Small Business Administration

“The Bank continued to ramp up the SBA department and SBA loan volume in 2022. A key contributing factor was the Bank being granted Preferred Lender Status (PLP), thus allowing the Bank to approve SBA 7a loans on behalf of the U.S. Small Business Administration. We also added new team members and strategically expanded our geographic lending footprint. The SBA team consists of seasoned, experienced bankers who all have a passion for small businesses and most importantly, for marking the lives of others.”

Tareasa Harrell

SVP, SBA Director

Remarkable Mortgage

Powered by Oconee State Bank

“Remarkable Mortgage was an agent of change in 2022, thanks in large part to its newly built technology infrastructure. These changes streamlined the lending process and made it easier than ever for customers to secure financing for their homes. Additionally, we introduced two new residential portfolio products, the Essential Loan and the Professional Loan, which quickly became popular options among homebuyers. With our cutting-edge technology and innovative loan products, Remarkable Mortgage is poised for a great 2023 home buying season.”

Charlie Fleming

President, Loan Officer

Executive Leadership

Cristi Donahue

EVP, Chief Administrative Officer

Jim McLemore

EVP, Chief Financial Officer

John Davis

EVP, Chief Innovation and Technology Officer

Neil Stevens

President, Chief Executive Officer

Philip Bernardi

EVP, Chief Banking Officer

Selena Ruth

EVP, Chief Human Resources Officer

Tom Wilson

EVP, Chief Credit Officer

Community Advisory Committees

Athens/Oconee

Andy Thoms

CEO & Co-Founder, See. Spark. Go.

Dan Elder

President, Oconee Well Drillers

Davis Knox

CEO & Co-Founder, Fire & Flavor

Delena Brockmann

Executive Director of Operations, Piedmont Athens Regional

Donald Hansford

Attorney at Law, Donald W. Hansford, PC

Dutch Guest

Vice President, LAD Truck Lines, Inc.

Elmer Stancil

Senior Managing Director, Dentons

Kevin Daniel

Pastor, Bethel Baptist Church

Lenn Chandler

Retired Vice President, Georgia Power

Robert Griffith

President, Golden Pantry

Gwinnett

Greg Cantrell

Broker/Owner, Living Stone Properties

Lee Merritt

Partner, Merritt Properties, Inc.

Marlon Allen

Partner, RAMP Marketing LLC

Matt Hyatt

President & CEO, Rocket IT

Rob Coatsworth

CEO, CTR Partners, Inc.

Russell Reece

Atlanta Managing Partner, Hancock Askew & Co.

Macon

Andrea Cooke

BSW Development Director, Southern Center for Choice Theory

Hall Harden

Agent, Alfa Insurance

Justin Andrews

Director of Special Projects & Outreach, Otis Redding Foundation

Katie Berg

Attorney at Law, Mayo Hill Law

Matt Cathey

Attorney at Law, Stone & Baxter LLP

Stephen Daugherty

CEO, Piedmont Hospital Macon

Board of Directors

Albert Hale, SR.

Joined in 2008

Board Vice- Chair, retired local dairy and poultry farmer, owner of Hale’s Dairy. Albert brings a balanced perspective to the Board of Directors. His demonstrated business experience, leadership skills, and management skills make him an excellent addition to our team.

Brian J. Brodrick

Joined in 2016

Partner & Board Member of Jackson Spalding. Brian has more than 26 years of strategic communications experience. He has worked the past 26 years at Jackson Spalding, Georgia’s leading independent marketing communications agency. Brian is also Mayor of the City of Watkinsville, Georgia.

G. Robert Bishop

Joined in 1991

Retired, Georgia Department of Natural Resources. Bob has served as a director since 1991. He obtained both his Bachelor’s degree and Master’s degree in Agricultural Engineering, from the University of Georgia, in 1969 and 1972, respectively. His business experience, together with his historical knowledge of the corporation, makes Bob an integral member of the Board of Directors.

Holly H. Stephenson

Joined in 2020

General Partner/Treasurer of Hardigree Properties & employed by Oconee County Board of Commissioners as the County Clerk. Holly has a long history with Oconee State Bank and as a 6th generation Oconee County native, and life-long resident, she has strong ties in Oconee County. She is a graduate of UGA’s Terry College of Business, where she earned a BBA in Risk Management. She proudly serves in many capacities in the local community.

Jonathan R. Murrow, MD

Joined in 2016

Cardiologist, Piedmont Heart Institute in Athens and Professor of Medicine at the Medical College of Georgia. Jonathan received his undergraduate degree from Harvard College. He earned his medical degree from Emory University School of Medicine in 2001. He completed his internal medicine residency at Johns Hopkins Hospital in 2004 and cardiovascular fellowship training at Hopkins and Emory.

Laura H. Whitaker

Joined in 2020

Executive Director, Extra Special People, Inc. Laura obtained both her Bachelor’s degree in Collaborative Special Education and her Master’s degree in Adapted Curriculum Classic Autism at the University of Georgia. She is an alumna of L.E.A.D Athens and Leadership Georgia and has served as a Board Member for United Way, while also serving as a member of North Oconee Rotary, Oconee Civitan, and the Junior League of Athens.

Neil Stevens

Joined in 2016

President & Chief Executive Officer, Oconee State Bank. Neil brings 33 years of broad-based banking experience to the team. Over the years, his main focus has been to lead financial institutions to levels of accelerated performance by placing a high emphasis on building a remarkable culture within the organization.

Toby Smith, CPA/CVA

Joined in 2017

Director of Financial Reporting & Assurance Services, Trinity Accounting Group, PC in Athens. Toby received his Bachelor of Business Administration from the University of Georgia in 1998 and is a member of the Georgia Society of CPA’s, the AICPA, and the National Association of Certified Valuation Analysts (NACVA). Toby is an alumnus of L.E.A.D. Athens and is active in the Athens area community.

Tony L. Powell

Joined in 2018

President, Powell Home Builders, Inc. Tony has a degree in Landscape Architecture from the University of Georgia and graduated high school from Oconee County High School. He is President and founder of Powell Home Builders, Inc., a custom home building company.

Virginia Wells McGeary

Joined in 1990

Board Chair, President & CEO, Wells & Co. Realtors, Inc. Virginia graduated from UGA’s Terry College of Business in 1982 with a degree in Banking and Finance. She has been in the real estate business for 47 years.

Junior Board of Directors

Founded in 1984 by H. Mell Wells, Oconee State Bank’s Junior Board of Directors is comprised of high school students throughout Oconee County. The students listed below have been nominated by teachers and selected by their schools to serve as the 2023 Junior Directors. The combined academic and extracurricular achievements of this year’s Board is unmatched. These students are making a difference and marking lives in their own right in their corner of the world. At Oconee State Bank, we are proud to fulfill our commitment to serving our local school systems through community education initiatives, and working directly with aspiring young leaders is an honor for our team. Going forward, in 2023 and beyond, our vision is to expand the Junior Board program across all markets we serve, creating remarkable education experiences for more student populations than ever before.

Oconee County High School

Brady Hawkins

Eileen Brook

Ellen Patterson

Nathaniel Hilyard

Rui Wang

Victor Huang

North Oconee High School

Evan Montgomery

Kyla Scott

Luke Waterworth

Matthew Guest

Mary Martin Stancil

Mary Webb

William Jackson Smith

Yehyun Hong

Athens Academy

Shelby Ladner

Isaiah Lavender

Westminster Christian Academy

Isabelle Stephens

John Donatelli

At-Home Study

Chloe Hammond

Who we are

Core Values

Vision

What are we trying to accomplish?

Mission

How will we accomplish our vision?

Our Values

What is most important to us as we strive to accomplish our vision?

We value… Success

S

the privilege of wisely shepherding the resources entrusted to us

U

Believing the best in, Expecting the best from, Seeking the best for, and Telling the best about each other

C

A culture of teamwork

C

Investing in the communities we serve through active engagement and local decision-making

E

Exceptional performance with a long-term perspective

S

Consistently creating remarkable experiences for our customers

S

A culture of teamwork

The Remarkable Foundation

Since 1960, Oconee State Bank has been grateful to partner with countless local charities, giving back to the same organizations who are making an impact in the communities we serve. In 2020, in recognition of our 60th Anniversary commemorative celebrations, we established our inaugural giving arm, coined The Remarkable Foundation!

The mission of The Remarkable Foundation is to provide financial assistance to nonprofit organizations, for the implementation of services and programs that enhance and mark the quality of life, for all people in the communities served by Oconee State Bank.

Customers, community members, local organizations, and beyond have an opportunity to link arms and partner with the established and reputable giving history of OSB, through the foundation, thus increasing our giving impact in every community we serve.

Meet the Remarkable Foundation Employee Board!

Andy Hancock

Technology Specialist

Brooke Waters

Business Development Officer

Casey Basham

Integrated Marketing Strategist

Cayce Reese

Executive Assistant

Dani Williams

VP, Loan Operations

Deesha Hagwood

VP, Marketing

JT Tomlin

Digital and Creative Strategist

Monica Wright

VP, SBA Operations Manager

Toggle the slider to see the different logo designs

P. O. Box 205

Watkinsville, GA 30677

Phone: 706.769.6611

Fax: 706.583.3844

info@oconeestatebank.com

www.oconeestatebank.com