2023

Annual Report

Annual Meeting

Monday, June 3, 2024 | 5 pm

Oconee State Bank

Corporate Headquarters

41 N. Main Street

Watkinsville, Georgia 30677

Investor Relations

James R. McLemore

Executive Vice President &

Chief Financial Officer

Oconee Financial Corporation

PO Box 205

Watkinsville, Georgia 30677

Transfer Agent

Broadridge Corporate Issuer Solutions

PO Box 1342

Brentwood, NY 11717

1-877-830-4936

Oconee Financial Corporation

41 N. Main Street

PO Box 205

Watkinsville, Georgia 30677

Telephone: (706) 769-6611

Facsimile: (706) 583-3878

www.oconeestatebank.com

Independent Registered Public Accounting Firm

Mauldin & Jenkins, LLC, Certified Public Accountants

200 Galleria Parkway, S.E.

Suite 1700

Atlanta, Georgia 30339

President’s Letter

Dear Shareholders,

I am pleased to present to you our annual report for 2023, a year in which Oconee State Bank continued to exhibit exceptional strength and performance.

Throughout the year, our commitment to our shareholders remained unwavering. Our dedicated team worked tirelessly every day, focusing on increasing shareholder value, and delivering outstanding results. I am proud to announce that we surpassed our budgeted net income target, which enabled us to enhance the dividends paid to our valued shareholders.

One of the highlights of 2023 was the successful acquisition of Elberton Federal Savings & Loan Association. This strategic move not only strengthened our presence, but also allowed us to welcome Bob Paul to our Board of Directors, who brings invaluable expertise and insight.

Furthermore, we expanded our Small Business Administration Department (SBA) by adding another talented SBA producer and welcoming a former SBA Division Manager, with a wealth of industry experience, to our Advisory Committee in Gwinnett County. These additions reflect our ongoing commitment to supporting small businesses and fostering growth in the communities we serve.

Amidst a turbulent interest rate environment, our team demonstrated exceptional skill in managing funding costs, further underscoring our ability to navigate challenges with resilience and agility.

I am immensely proud of the strength and talent of our team at Oconee State Bank. Their commitment to excellence has been instrumental in our success.

As we look to the future, we remain steadfast in our vision to be essential to the lives, businesses, and communities we serve. Our mission to create remarkable experiences that significantly mark the lives of others, guides our every decision, while our core values of Stewardship, Unity, Collaboration, Community, Excellence, Service, and Solutions continue to shape our actions.

On behalf of our entire team, I extend my heartfelt gratitude for your investment, trust, and continued support. Each day, we strive to uphold our goal to become Georgia’s most remarkable community bank.

Neil Stevens

President and CEO

Financials

”Oconee State Bank's and Oconee Financial Corporation's financial results for 2023 reflect a significant improvement over 2022. We're particularly proud of this accomplishment in a year where banking industry earnings were down overall.

Jim McLemoreChief Financial Officer

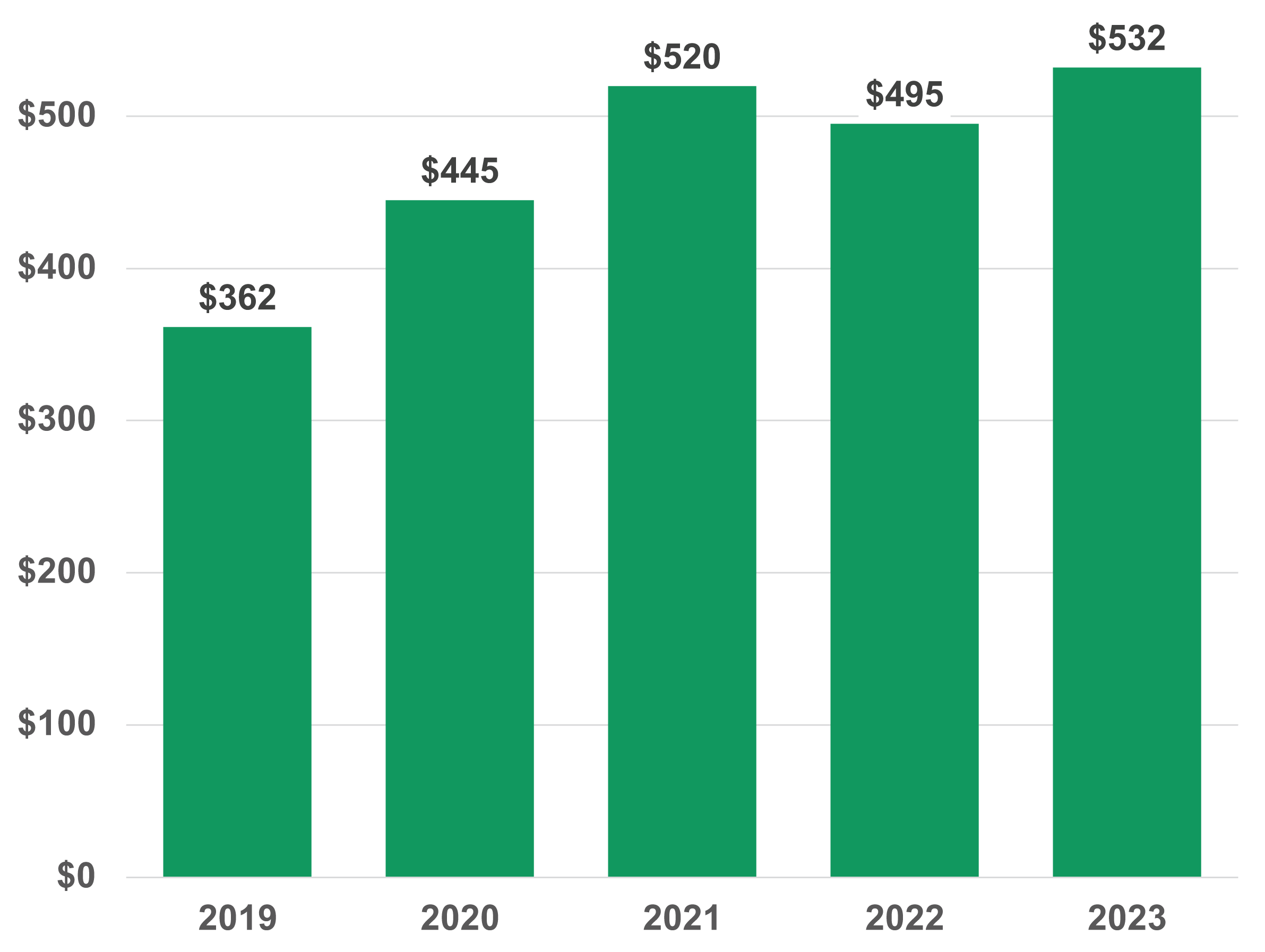

2023 Results: Earnings, Dividends, Book Value, and Stock Value

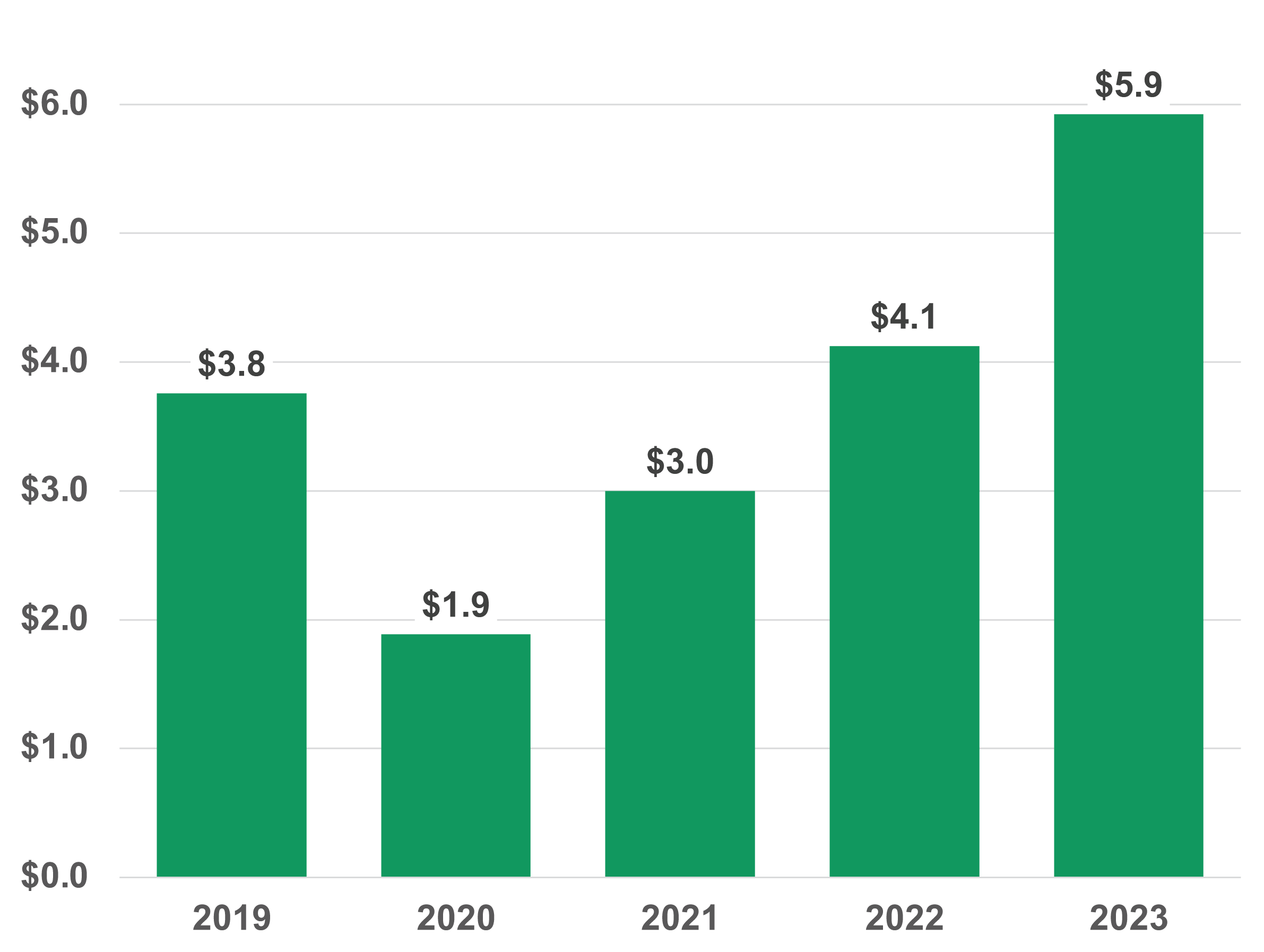

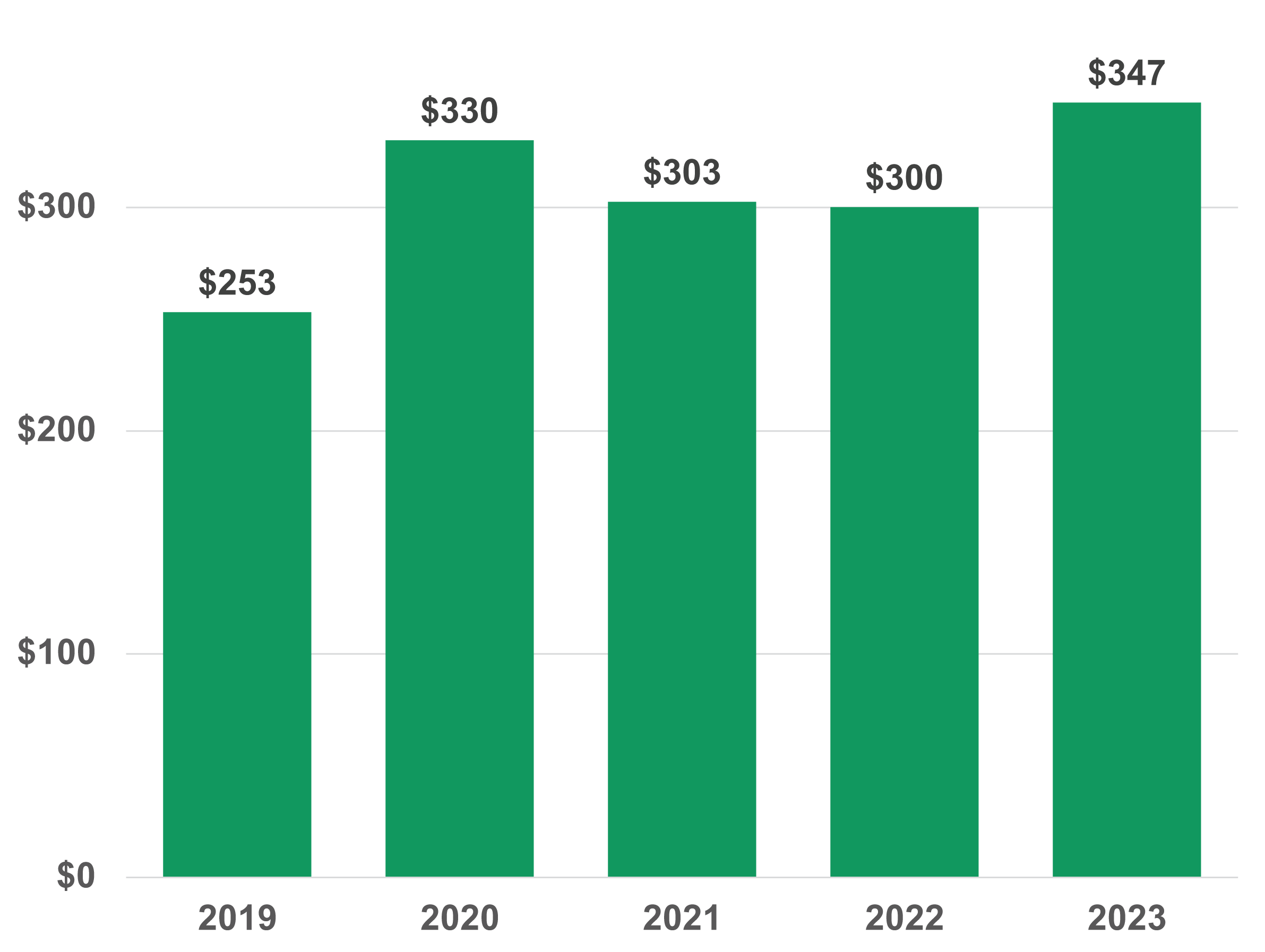

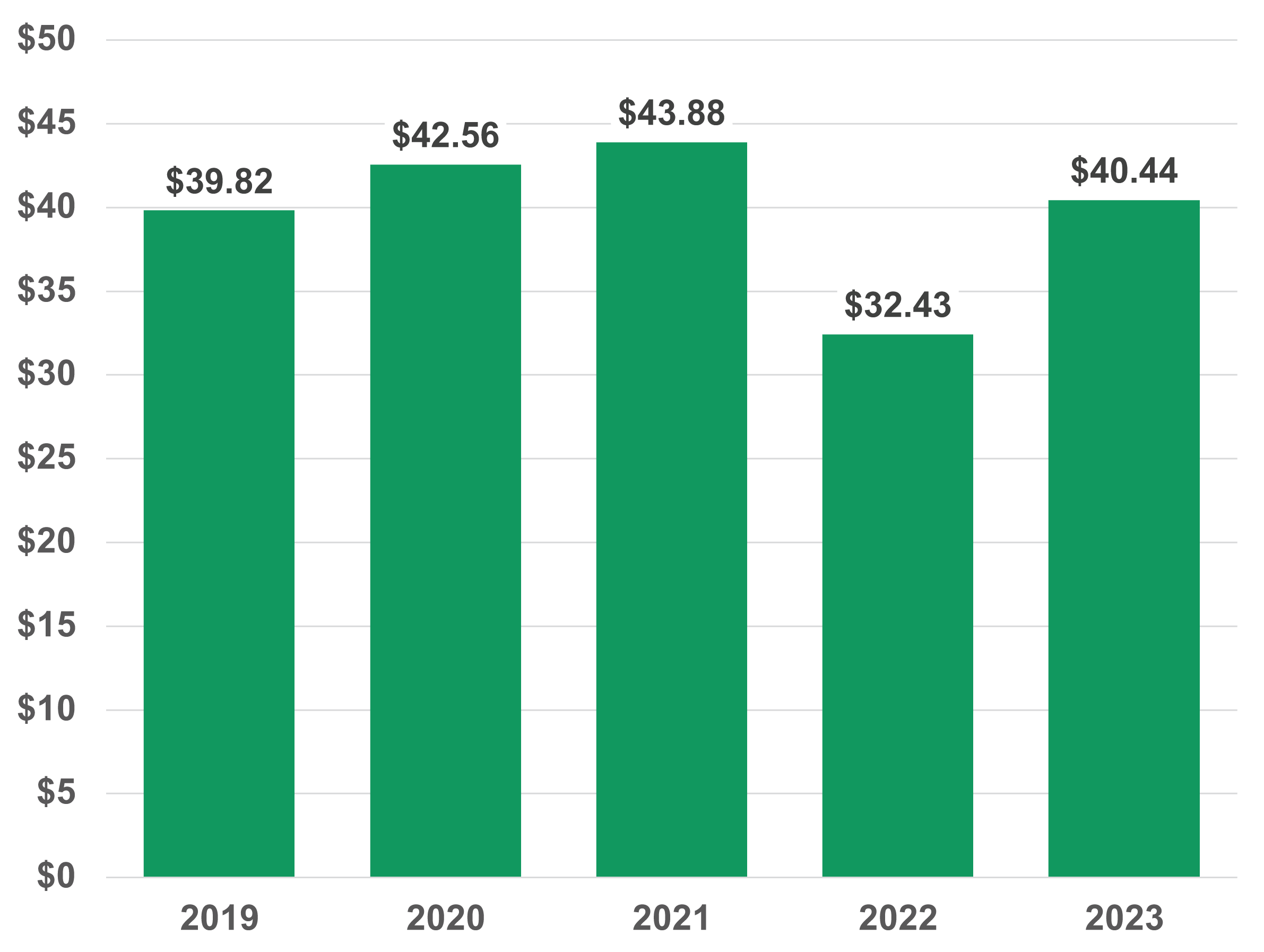

Oconee State Bank’s and Oconee Financial Corporation’s financial results for 2023 reflect a significant improvement over 2022. We’re pleased to report 2023 net income of $5.9 million versus $4.1 million for 2022. Excluding a bargain purchase gain of $1.8 million and related merger expenses of $625,000 associated with our merger with Elberton Federal, net income for 2023 was $4.6 million. This represents an increase of 10.6% over 2022’s earnings of $4.1 million. The increase in net income was primarily driven by higher net interest income of $4.2 million resulting from higher interest rates, offset by an increase in total noninterest expense of $3.2 million. Oconee Financial Corporation paid a dividend of $0.85 per share in April 2023, which represents an increase of 21 percent over 2022’s dividend of $0.70 per share. Our book value per share increased from $32.43 to $40.44, an increase of 25 percent. This is primarily due to the retention of earnings and reduction in unrealized losses in our bond portfolio in 2023 of $2.7 million. The Board of Directors recently voted to increase the 2024 annual dividend to $0.95 per share, an increase of 12 percent over 2023’s dividend. Oconee Financial Corporation’s stock, which trades on the OTCQX exchange under the ticker symbol “OSBK,” decreased from $37.11 per share at year-end 2022 to $31.33 per share at year-end 2023. At the time of this writing, the share price of OSBK stock was $34.35 per share.

Balance Sheet

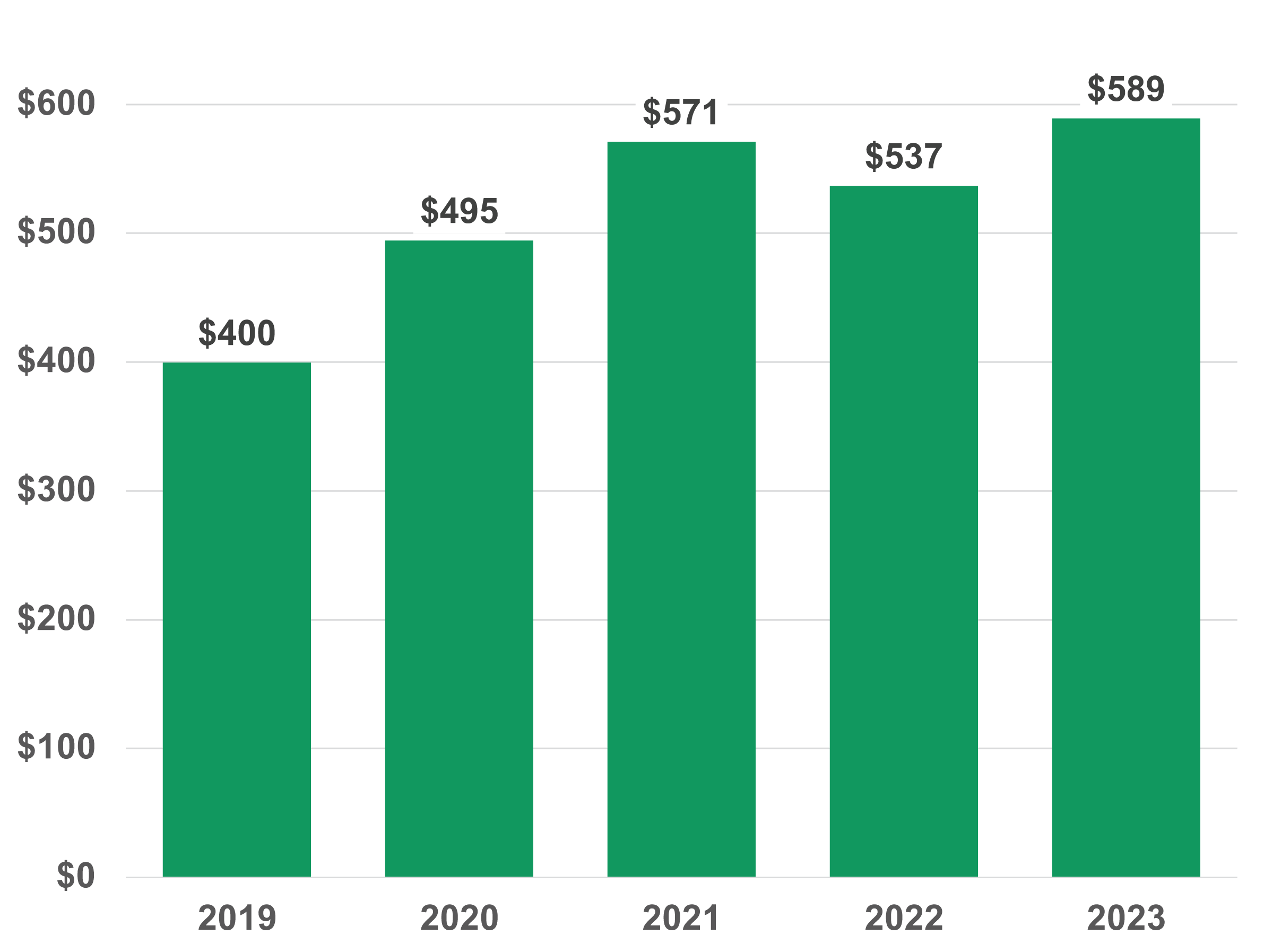

The Bank ended the year at $589.1 million in assets. This represented an increase of $52.3 million, or 9.7% versus year end 2022. The increase in assets is largely due to the acquisition of $16 million of deposits from the Elberton Federal merger, as well as an increase in non-acquired deposits of $21 million, or 4%. Our non-acquired deposit growth was strong in relation to what was experienced in the banking industry overall, as the median bank saw an increase in deposits of less than 1%. We continue to heavily focus on expanding the deposit relationship with our existing and prospective customers with the objective of making Oconee State Bank their primary financial institution.

In July 2023, the Company completed a successful offering of common stock in conjunction with the Elberton Federal merger. The offering raised $2.8 million of new common equity, net of related expenses.

Lending and Credit Quality

Total loans increased $46.9 million over year end 2022. The Bank acquired $19.5 million of loans in the Elberton merger and the remaining $27.4 million of non-acquired loan growth represents a very strong 9% increase over year end 2022 total loans. Past dues remain low and were only 1.47% of loan balances at 12/31/23. For 2023, we had loan recoveries of $60,000 and charge offs of $52,000, which resulted in a net recovery of $8,000.

Financial Highlights

(Dollars in thousands, except per share data)

2023

2022

Financial Condition at December 31,

Total assets

$ 589,058

$ 536,748

Investment securities

159,634

159,640

Loans (net of unearned income)

346,988

300,130

Allowance for loan losses

(4,600)

(4,549)

Total deposits

531,966

494,870

Subordinated notes

9,342

9,818

Shareholders’ equity

42,311

29,083

Results of Operations for the Year Ending December 31,

Interest income

$ 26,450

$ 17,852

Interest expense

5,838

1,443

Net interest income

20,612

16,409

Provision for loan losses

225

0

Net interest income after provision for loan losses

20,387

16,409

Noninterest income

6,074

4,850

Noninterest expenses

19,207

15,930

Income before income taxes

7,254

5,329

Income tax expense

1,328

1,205

Net income

$ 5,926

$ 4,124

Per Share Data

Earnings per share

6.32

4.60

Cash dividends paid

0.85

0.70

Book value per common share

40.44

32.43

Weighted average shares outstanding

937,599

896,991

Performance Ratios

Return on average assets

1.14%

0.75%

Return on average equity

18.39%

13.29%

Net interest margin

3.74%

3.20%

Efficiency ratio

71.97%

75.54%

Net Income ($Millions)

Total Loans ($Millions)

Book Value Per Share

Total Assets ($Millions)

Total Deposits ($Millions)

Asset Quality Highlights

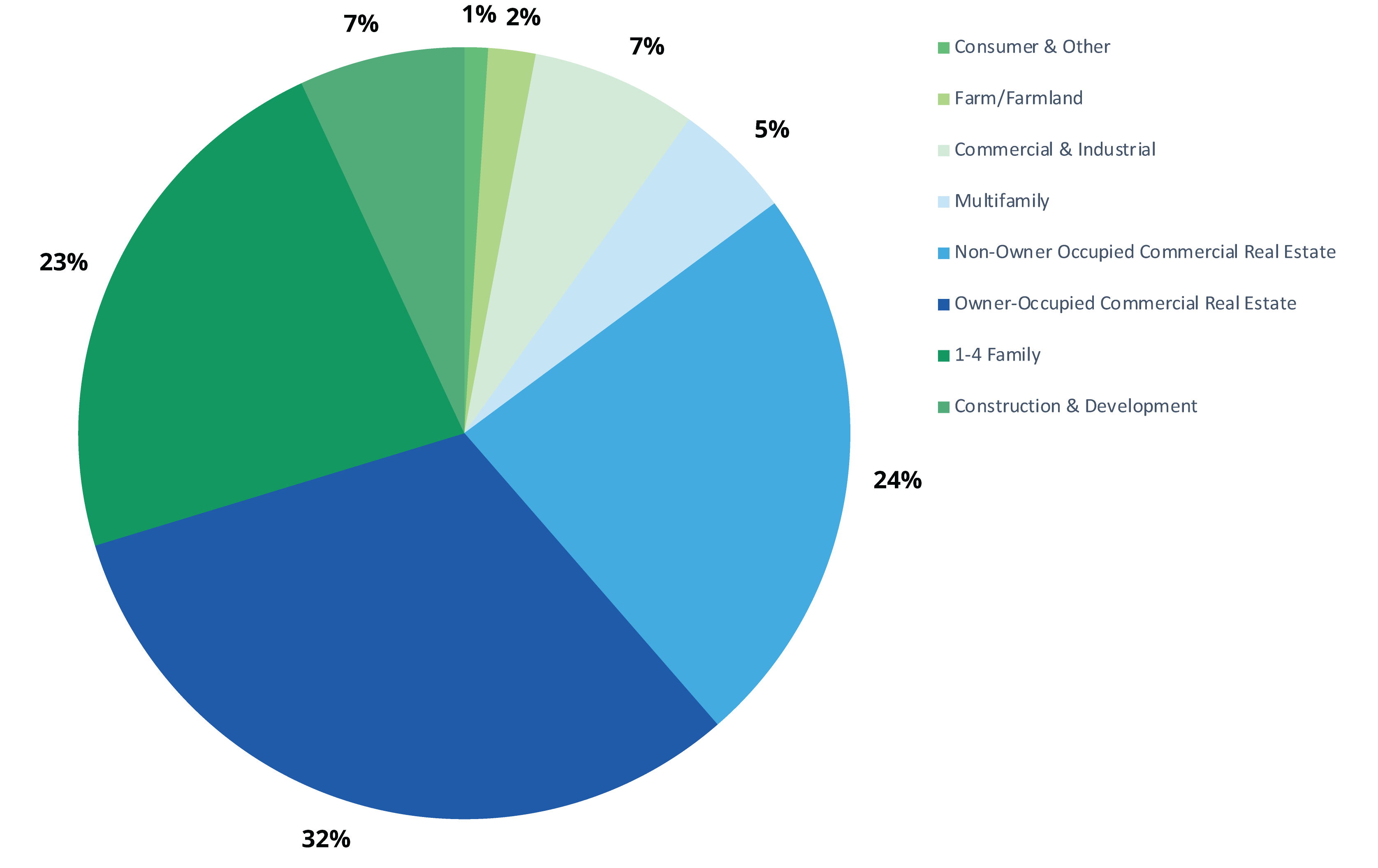

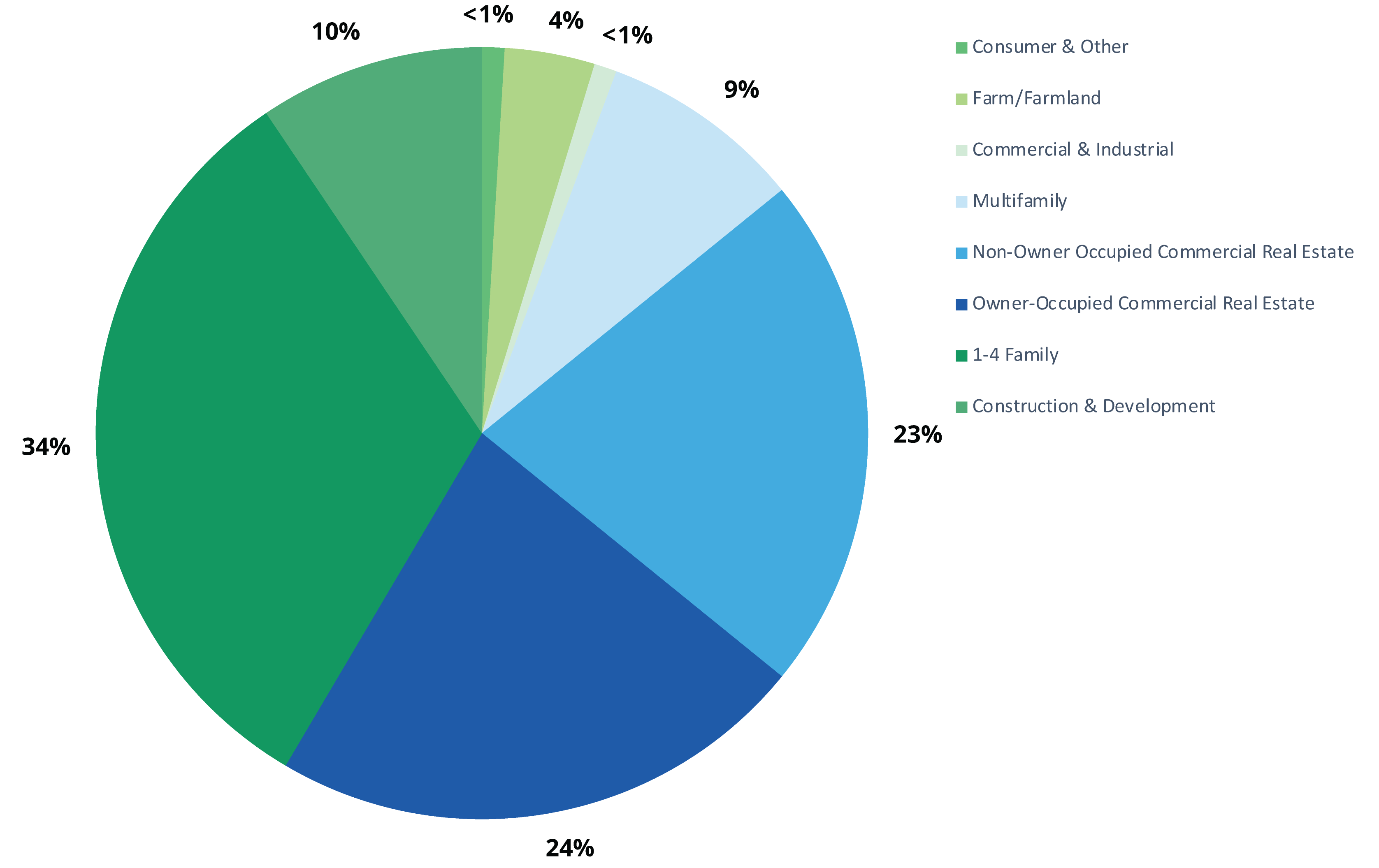

The Bank continues to place its highest emphasis on growing the Owner-Occupied Commercial Real Estate portion of our loan portfolio, which is demonstrated by it being the largest segment of the loan portfolio at 32%. This strategy is based upon these loans representing (1) a significant influence on garnering the entire banking relationship of the business and business owners and (2) one of the safest categories of loans in the marketplace. Additionally, the Bank continues to maintain a well-balanced loan portfolio mix with 24% of the portfolio in a diversified mix of Non-Owner Occupied Commercial Real Estate, and 23% of the portfolio in various types of 1 to 4 Family Housing loans. The merger-conversion of Elberton Federal Savings & Loan Association (Elberton) into the Bank during 2023 resulted in net acquired loan balances at December 31, 2023 of $18.9 million, with the vast majority of that portfolio being in the 1-4 Family Residential Portfolio. As a result of these acquired loans, as well as organic growth in both Home Equity Credit Lines and Portfolio Mortgages, the 1-4 Family Residential Portfolio increased 56% during the year. As a result of increased Small Business Administration guaranteed loan volume in 2023 the Commercial & Industrial loan portfolio grew by 80%.

12/31/2023 Loan Portfolio Composition

Historical Charts

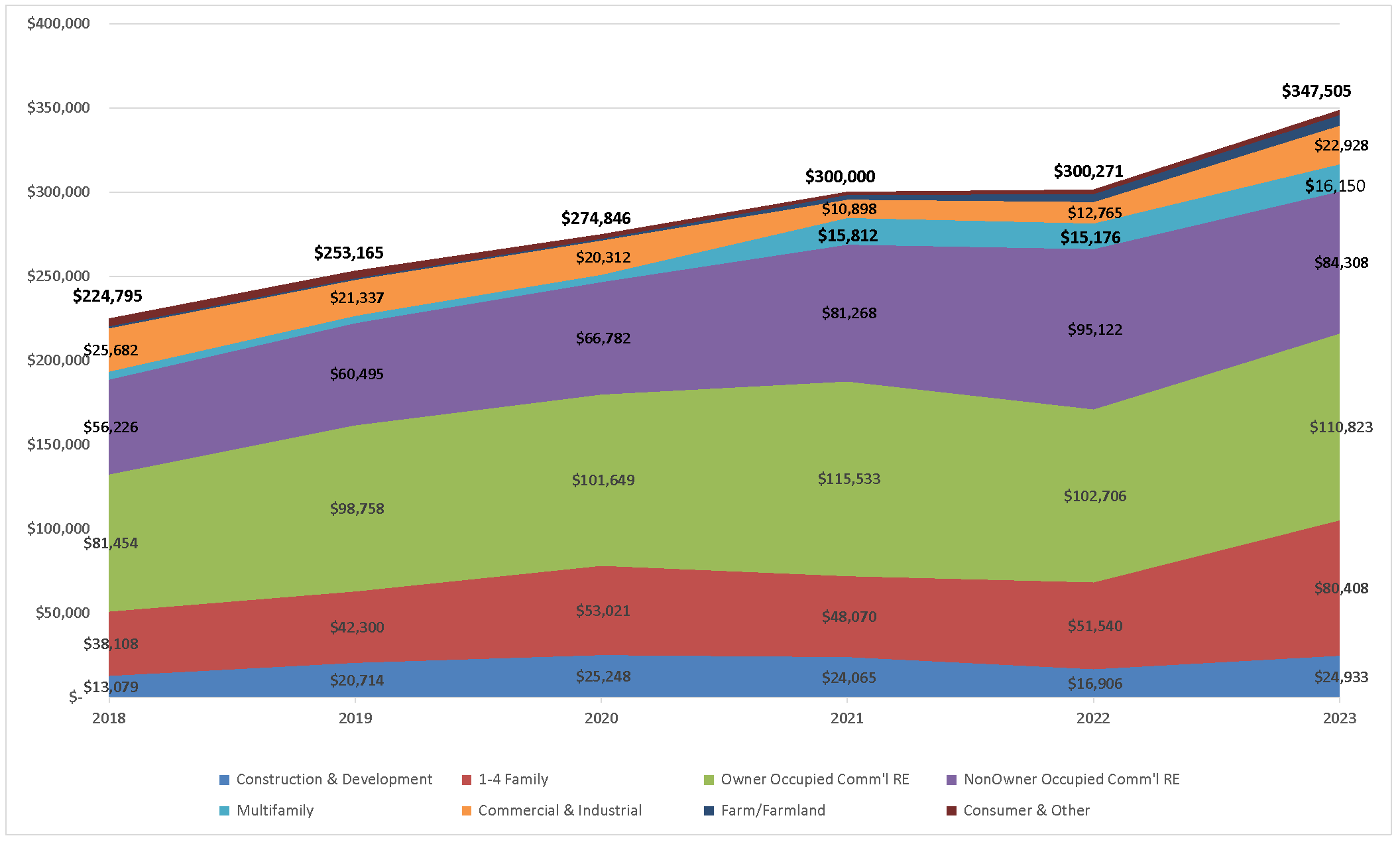

In 2023 the Bank reflected strong growth of $47.2 million (16%). The Elberton merger-conversion resulted in $18.9 million of that growth. Organic growth was still strong at $28.3 million (9%). This organic growth was across several loan categories led by Small Business Administration guaranteed portfolio growth ($10 million), Owner-Occupied Commercial Real Estate Construction Growth ($9.5 million), and Owner-Occupied Commercial Real Estate Growth ($8 million).

During 2023, the Bank continued to produce good volume of new loan closings with much of this volume being in our target segment of Owner-Occupied Commercial Real Estate. Within this the new loan volume, we continue to see good volume of Commercial Real Estate Construction loans, which has resulted in the unfunded portion of this category of loans continuing to be approximately $18 million at year-end. We anticipate these loans fully funding over time, which should translate into future growth.

Over the last five years, the Bank has grown the loan portfolio by 55% and excluding Elberton that growth has been 46% or a Compound Annual Growth Rate of 8%. Additionally, during these five years (excluding Elberton), the Bank’s focus on growing small business relationships, by targeting Owner-Occupied Commercial Real Estate loans, has resulted in that portion of the loan portfolio accounting for 28% of the growth, growing by 36%. Similarly, Non-Owner Occupied Commercial Real Estate has accounted for 27% of the growth, and 1 to 4 Family Housing loans have accounted for 21% of the growth.

5 Year Loan Growth Portfolio

Percentage of Total Growth by Segment

2018 – 2023

Historical Loan Portfolio Totals and Composition (000's)

(2020 & 2021 excluding Small Business Administration Paycheck Protection Program outstandings of $55,237 and $3,736, respectively)

Loan Loss Reserve, Loan Loss Provision, & Net Charge Offs (000's)

Digital Highlights

Business Services

238,703,191.91

105,182

65,212.84

130,967,603.72

40,551.36

157,997.23

eBanking Services

41,083,863.58

26,121

13,977.28

36,972,781.10

32,350

Cyber Security & IT Highlights

Our Information Technology Division plays a lead role in maintaining our network systems. As cyber threats continue to evolve, this team is instrumental in ensuring formidable barriers to protect our customers from cyber-attacks, data breaches, and other threats that may put personal and financial data at risk. A key component of mitigating cyber risk is awareness and education of those we serve. The following information illustrates how all stakeholders can be aware, join forces with their financial institutions, to further strengthen our stance against cybercrime.

Andy Hancock

Technology Specialist

Christian Watkins

Technology Specialist

Jamie McFalls

Vice President, Information Technology

John Davis

Executive Vice President, Chief Innovation and Technology Officer

2023 Stats

Phishing is the most common cyber threat facing individuals and businesses.

40,000

2400000

3400000000

46

8000000000000

85

25

81

95

Tip

When on a public network, always use a VPN (Virtual Private Network) to protect your data from threats or even if you are browsing the web. There are many options available for purchase.

We are thankful for our talented Information Technology Team, not only for their work in the cyber space, but also for all they do to ensure our team has the technology, at their fingertips, to serve our customers with excellence.

Retail

We opened our Macon Financial Center in April 2023! Led by Senior Vice President/Community President, Robby Redmond, we are excited for everyone to Experience Remarkable in this new market!

On August 1, 2023, in the heart of Downtown Elberton, we opened our newest financial center! The Elberton Financial Center team is excited and ready to serve Elbert County and surrounding areas!

Market Teams

Oconee

“2023 was a year of hard work and success for the Oconee Market Team. In a very challenging deposit and loan rate environment, we were able to successfully manage our deposits, as well as grow loans by over four million dollars, allowing the bank to achieve budget. We were very active in the community in 2023 and were able to capitalize on the opportunities presented to us through those activities. There is a lot of momentum carrying us into 2024 and we are excited to continue to serve our customers and community in an exceptional way.”

Hal Jackson

Senior Vice President, Community President/Oconee

Athens

“2023 brought a year of great and continuing growth for the Athens Market! Our team has experienced success in establishing its roots here with loans increasing to over $110 million and deposits in excess of $52 million, even in a competitive rate environment. We look forward this year to continued focus on deepening relationships with our existing clients, while also expanding our footprint in the Classic City and beyond.”

Chad Thomason and Phillip Edwards

Senior Vice Presidents, Community Presidents/Athens

Gwinnett

“In addition to the exceptional loan growth, recognition as Best of Gwinnett, and individual accolades for team members, Gwinnett Financial Center also successfully met its financial budget for the year 2023. By meeting its financial budget, Gwinnett Financial Center not only demonstrates its ability to achieve its financial goals, but also reinforces its credibility and reliability as a financial institution. This accomplishment further solidifies the institution’s position as a trusted partner for its customers, investors, and stakeholders.”

Joe Godfrey

Senior Vice President, Community President/Gwinnett

Macon

“The Macon Financial Center officially opened its doors on April 10 with a grand opening held on May 16 that was a huge success with a large outpouring of support from the community. Despite operating in a rising rate environment, loan growth picked up in the latter part of 2023 with tremendous deposit growth in only 8 short months. We continue to spread the Oconee State Bank brand across Macon and Central Georgia by immersing ourselves in and establishing new relationships within our community. We greatly appreciate each of our customers, our OSB family, and look forward to remarkable results in 2024.”

Robby Redmond

Senior Vice President, Community President/Macon

Elberton

“Perhaps one of our most exciting market successes for 2023 comes from our newest location – our Elberton financial center. OSB’s merger with Elberton Federal Savings and Loan was complete in August of 2023. We celebrated with a fantastic grand opening event introducing OSB to the local community. With this merger, we welcomed some of our newest team members who are an integral piece of the surrounding area and are excited to have the opportunity to bring OSB’s brand and remarkable service to our newest market! “

Chad Thomason and Phillip Edwards

Senior Vice Presidents, Community Presidents/Elberton

Small Business Administration

“The Bank is dedicated to the growth and success of its Small Business Administration lending division. Through its investment in people, training and technology, the Small Business Administration team is well positioned to continue providing a valuable source of non-interest income to the Bank’s bottom line, while mitigating credit risks through utilization of the Small Business Administration guaranty program.”

Tareasa Harrell

Senior Vice President, Small Business Administration Director

Remarkable Mortgage

Powered by Oconee State Bank

“In 2023, Remarkable Mortgage continued to redefine excellence in the real estate market, making a mark on our community through a blend of cutting-edge technology and innovative portfolio products. Leveraging state-of-the-art digital solutions, we streamlined the mortgage process, ensuring efficiency and ease for our clients. Our commitment to innovation extended to a diverse range of portfolio products, offering tailored solutions to meet the unique needs of our community members. By embracing technology and pushing the boundaries of traditional financing, we empowered individuals and families to achieve their dreams of homeownership. As we reflect on the year, our impact resonates not just in numbers, but in the lives we’ve touched, fostering a thriving and connected community for years to come.”

Charlie Fleming

President, Loan Officer

Executive Leadership

Cristi Donahue

Executive Vice President, Chief Administrative Officer

Jim McLemore

Executive Vice President, Chief Financial Officer

John Davis

Executive Vice President, Chief Innovation and Technology Officer

Neil Stevens

President, Chief Executive Officer

Philip Bernardi

Executive Vice President, Chief Banking Officer

Selena Ruth

Executive Vice President Chief Human Resources Officer

Tom Wilson

Executive Vice President, Chief Credit Officer

Community Advisory Committees

Oconee

David Branch

CEO/Founder, Branch Environmental

Delena Brockmann

Executive Director of Operations, Piedmont Athens Regional

Lenn Chandler

Retired Vice President, Georgia Power

Kevin Daniel

Pastor

Dan Elder

President, Oconee Well Drillers

Dutch Guest (Not Pictured)

Vice President, LAD Truck Lines, Inc.

Donald Hansford

Attorney at Law, Donald W. Hansford, PC

Meredith Marlowe

Hospice Social Worker

Elmer Stancil

Senior Managing Director, Dentons

Gwinnett

Glenn Aldridge

Shareholder, Aldridge & Associates

Marlon Allen

Owner, RAMP Sportswear LLC

Matt Bryant

Retired Banker

Greg Cantrell

Broker/Owner, Living Stone Properties

Rob Coatsworth

CEO, CTR Partners, Inc.

Matt Hyatt

President & CEO, Rocket IT

Lee Merritt (Not Pictured)

Partner, Merritt Properties, Inc.

Macon

Justin Andrews (Not Pictured)

Director of Special Projects & Outreach, Otis Redding Foundation

Katie Berg

Real Estate Attorney, Mayo Hill Law

Kenny Burgamy

Director of PR/Information for GA Farm Bureau

Matt Cathey (Not Pictured)

Attorney at Law, Partner at Stone & Baxter LLP

Andrea Cooke

Director of Development, The Southern Center for Choice Theory and Executive Director of C-QUL

Stephen Daugherty

CEO, Piedmont Hospital Macon

Hall Harden

Insurance Sales and Management, Harden Insurance Agency – Alfa

Board of Directors

G. Robert Bishop

Joined in 1991

Retired, Georgia Department of Natural Resources. Bob has served as a director since 1991. He obtained both his Bachelor’s degree and Master’s degree in Agricultural Engineering, from the University of Georgia, in 1969 and 1972, respectively. His business experience, together with his historical knowledge of the corporation, makes Bob an integral member of the Board of Directors.

Brian J. Brodrick

Joined in 2016

Partner & Board Member of Jackson Spalding. Brian has more than 26 years of strategic communications experience. He has worked for the past 26 years at Jackson Spalding, Georgia’s leading independent marketing communications agency. Brian is also the Mayor of the City of Watkinsville, Georgia.

Albert Hale, SR.

Joined in 2008

Board Vice- Chair, retired local dairy and poultry farmer, owner of Hale’s Dairy. Albert brings a balanced perspective to the Board of Directors. His demonstrated business experience, leadership skills, and management skills make him an excellent addition to our team.

Virginia Wells McGeary

Joined in 1990

Board Chair, President & CEO, Wells & Co. Realtors, Inc. Virginia graduated from UGA’s Terry College of Business in 1982 with a degree in Banking and Finance. She has been in the real estate business for 47 years.

Jonathan R. Murrow, MD

Joined in 2016

Cardiologist, Piedmont Heart Institute in Athens and Professor of Medicine at the Medical College of Georgia. Jonathan received his undergraduate degree from Harvard College. He earned his medical degree from Emory University School of Medicine in 2001. He completed his internal medicine residency at Johns Hopkins Hospital in 2004 and cardiovascular fellowship training at Hopkins and Emory.

Robert Paul

Joined in 2023

Vice President & General Manager at Eagle Granite Co., Inc. Bob has a degree in English from Furman University. He grew up in Elberton. He provides insight ensuring exceptional customer experiences and connection throughout Elberton.

Tony L. Powell

Joined in 2018

President, Powell Home Builders, Inc. Tony has a degree in Landscape Architecture from the University of Georgia and graduated high school from Oconee County High School. He is President and founder of Powell Home Builders, Inc., a custom home building company.

Toby Smith, CPA/CVA

Joined in 2017

Director of Financial Reporting & Assurance Services, Trinity Accounting Group, PC in Athens. Toby received his Bachelor of Business Administration from the University of Georgia in 1998 and is a member of the Georgia Society of CPA’s, the AICPA, and the National Association of Certified Valuation Analysts (NACVA). Toby is an alumnus of L.E.A.D. Athens and is active in the Athens area community.

Holly H. Stephenson

Joined in 2020

General Partner/Treasurer of Hardigree Properties & employed by Oconee County Board of Commissioners as the County Clerk. Holly has a long history with Oconee State Bank and as a 6th generation Oconee County native, and life-long resident, she has strong ties in Oconee County. She is a graduate of UGA’s Terry College of Business, where she earned a BBA in Risk Management. She proudly serves in many capacities in the local community.

Neil Stevens

Joined in 2016

President & Chief Executive Officer, Oconee State Bank. Neil brings 33 years of broad-based banking experience to the team. Over the years, his main focus has been to lead financial institutions to levels of accelerated performance by placing a high emphasis on building a remarkable culture within the organization.

Laura H. Whitaker

Joined in 2020

Chief Executive Officer, Extra Special People, Inc. Laura obtained both her Bachelor’s degree in Collaborative Special Education and her Master’s degree in Adapted Curriculum Classic Autism at the University of Georgia. She is an alumna of L.E.A.D Athens and Leadership Georgia and has served as a Board Member for United Way, while also serving as a member of North Oconee Rotary, Oconee Civitan, and the Junior League of Athens.

Junior Board of Directors

Oconee State Bank’s Junior Board of Directors is comprised of high school students throughout Oconee County. The students listed below have been nominated by teachers and selected by their schools to serve as the 2023-2024 Junior Directors. The combined academic and extracurricular achievements of this year’s Board is unmatched. These students are making a difference and marking lives in their own right in their corner of the world. At Oconee State Bank, we are proud to fulfill our commitment to serving our local school systems through community education initiatives. Working directly with aspiring young leaders is an honor for our team! Going forward, in 2024 and beyond, our vision is to expand the Junior Board program across all markets we serve, creating remarkable education experiences for more student populations than ever before.

Oconee County High School

Briggs Stoll

Campbell Patterson

Charles Carter

Emma Donahue

Kinlee Hagwood

Leah Powell

Stephen Resutek

North Oconee High School

Matthew Clausen

Priscilla Hoang

Rahul Mohanty

Rohan Mohanty

Samuel Im

Athens Academy

Oswaldo Jara-Rivera

Roman Ritchy

Westminster Christian Academy

Catherine McCormack

William Greene

Prince Avenue

John Luke Bishop

Porter Ward

Who we are

Core Values

Vision

What are we trying to accomplish?

Mission

How will we accomplish our vision?

Our Values

What is most important to us as we strive to accomplish our vision?

We value… Success

S

the privilege of wisely shepherding the resources entrusted to us

U

Believing the best in, Expecting the best from, Seeking the best for, and Telling the best about each other

C

A culture of teamwork

C

Investing in the communities we serve through active engagement and local decision-making

E

Exceptional performance with a long-term perspective

S

Consistently creating remarkable experiences for our customers

S

A culture of teamwork

The Remarkable Foundation

Since 1960, Oconee State Bank has been grateful to partner with countless local charities, giving back to the same organizations who are making an impact in the communities we serve. In 2020, in recognition of our 60th Anniversary commemorative celebrations, we established our inaugural giving arm, coined The Remarkable Foundation!

The mission of The Remarkable Foundation is to provide financial assistance to nonprofit organizations, for the implementation of services and programs that enhance and mark the quality of life, for all people in the communities served by Oconee State Bank.

Customers, community members, local organizations, and beyond have an opportunity to link arms and partner with the established and reputable giving history of OSB, through the foundation, thus increasing our giving impact in every community we serve.

If you would like to partner with Oconee State Bank through a donation to The Remarkable Foundation visit our website below.

Our team is dedicated to giving back to our communities.

We had the incredible opportunity to serve 36 non-profit organizations.

Given by OSB Employees, Board Members, and Community Advisory Members.

Meet the Employee Board

Andy Hancock

Technology Specialist

Brooke Waters

Business Development Officer

Casey Basham

Integrated Marketing Strategist

Cayce Reese

Executive Assistant

Dani Williams

Vice President, Loan Administration

Deesha Hagwood

Vice President, Marketing

JT Tomlin

Digital & Creative Strategist

Kevin Jones

Business Development Officer

Monica Wright

Vice President, Small Business Administration Operations Manager

New Developments

In 2023, the Oconee State Bank Make Your Remarkable Podcast was launched as a channel to connect and unite people from all walks of life to learn about leadership, personal growth, and much more. The goal of the podcast is to ignite purpose and inspire passion in our listeners by talking to local influencers about their road to success and leaving a lasting mark on their community. “Make Your Remarkable” is here to help you answer the question, “How are you making your remarkable?”

Subscribe on any streaming platform for new episodes and follow us on social media at @oconeestatebank.

Make Your Remarkable Trailer

P. O. Box 205

Watkinsville, GA 30677

Phone: 706.769.6611

Fax: 706.583.3844

info@oconeestatebank.com

www.oconeestatebank.com